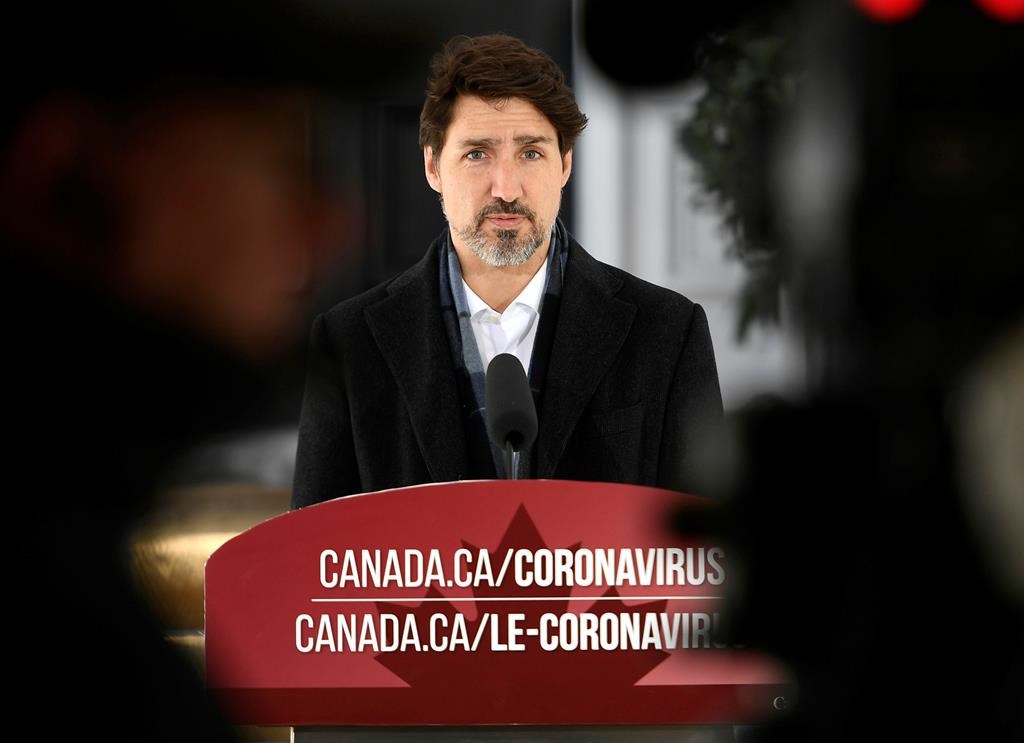

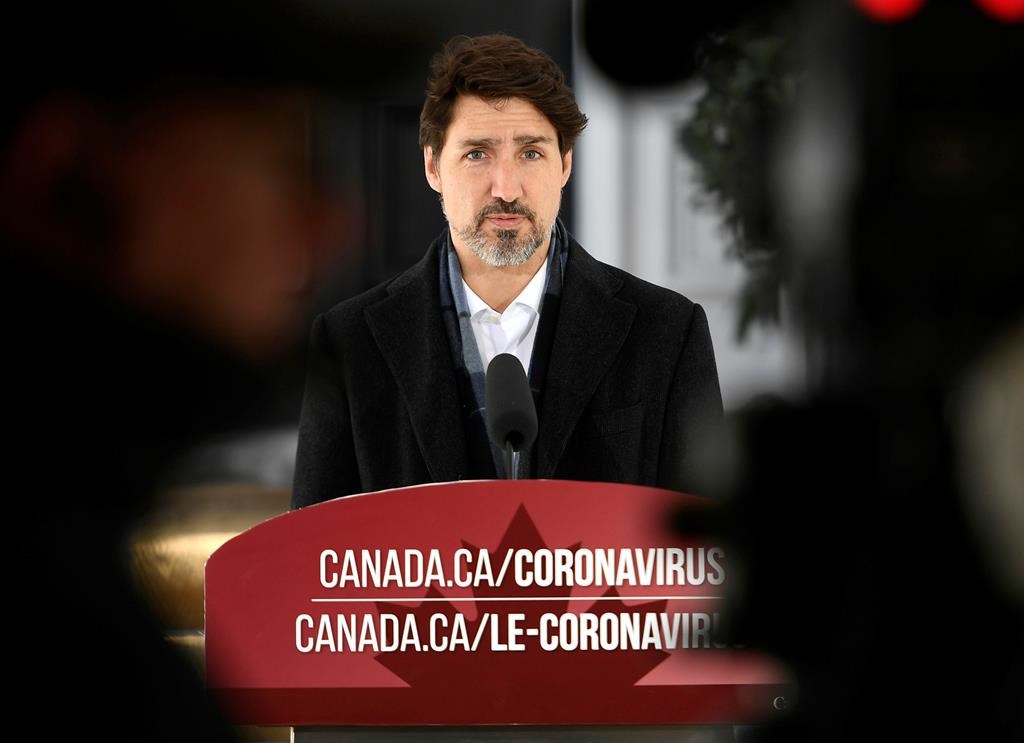

LEEFF will help keep Canadian jobs الحكومة تدعم الشركات الكبرى للحفاظ على وظائف الكنديين

كشف رئيس الوزراء الكندي جاستن ترودو عن خطوة جديدة لدعم الشركات الكبرى ماليا للحفاظ على موظفيها وضمان عدم تسريح العاملين بها

الخطوة الجديدة من جانب الحكومة ستقدم قروضا ومنحا للشركات التي تحقق دخلا يساوي أو يزيد على 300 مليون دولار

البرنامج الجديد الذي يضم العديد من التفاصيل يشترط توافر أمور معنية في أي شركة تتأهل للحصول على المساعدات كما يشترط أيضا التزام تلك الشركات بأمور معينة من بينها الالتزام بالتغير المناخي ووضع شروط ومعايير صارمة لضمان عدم استخدام تلك التسهيلات في دفع رواتب هائلة لكبار مديرها أو استخدام تلك الأموال في إعادة شراء أسهمها بما يحمي أموال دافي الضرائب في كندا

التفاصيل الكاملة للبرنامج الجديد الذي يعرف اختصارا بالحروف LEEFF يمكن معرفتها من خلال الخبر بالانجليزية هنا

The Prime Minister, Justin Trudeau, today announced new measures to support businesses so they can keep their workers on the payroll and weather this pandemic.

- Establish a Large Employer Emergency Financing Facility (LEEFF) to provide bridge financing to Canada’s largest employers, whose needs during the pandemic are not being met through conventional financing, in order to keep their operations going. The objective of this support is to help protect Canadian jobs, help Canadian businesses weather the current economic downturn, and avoid bankruptcies of otherwise viable firms where possible. This support will not be used to resolve insolvencies or restructure firms, nor will it provide financing to companies that otherwise have the capacity to manage through the crisis. The additional liquidity provided through LEEFF will allow Canada’s largest businesses and their suppliers to remain active during this difficult time, and position them for a rapid economic recovery.

- Use key guiding principles in providing support through the LEEFF, including:

- Protection of taxpayers and workers: Companies seeking support must demonstrate how they intend to preserve employment and maintain investment activities. Recipients will need to commit to respect collective bargaining agreements and protect workers’ pensions. The LEEFF program will require strict limits to dividends, share buy-backs, and executive pay. In considering a company’s eligibility to assistance under the LEEFF program, an assessment may be made of its employment, tax, and economic activity in Canada, as well as its international organizational structure and financing arrangements. The program will not be available to companies that have been convicted of tax evasion. In addition, recipient companies would be required to commit to publish annual climate-related disclosure reports consistent with the Financial Stability Board’s Task Force on Climate-related Financial Disclosures, including how their future operations will support environmental sustainability and national climate goals.

- Fairness: To ensure support across the Canadian economy, the financing is intended to be applicable to all eligible sectors in a consistent manner.

- Timeliness: To ensure timely support, the LEEFF program will apply a standard set of economic terms and conditions.

- Expand the Business Credit Availability Program (BCAP) to mid-sized companies with larger financing needs. Support for mid-market businesses will include loans of up to $60 million per company, and guarantees of up to $80 million. Through the BCAP, Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) will work with private sector lenders to support access to capital for Canadian businesses in all sectors and regions.

- Continue to provide financing to businesses through Farm Credit Canada, the BDC, and EDC, including through the Canada Account. This will ensure the government is able to respond to a wide range of financing needs, including for some large employers facing higher risks, with stricter terms in order to adequately protect taxpayers.